The periodic revision of salary and pension scales for government employees plays a crucial role in ensuring financial stability for millions of workers and retirees. These adjustments, which typically occur every ten years, are designed to keep pace with inflation, the economic environment, and the cost of living. The government’s periodic pay scale and pension increment updates not only benefit those currently in service but also offer a significant boost to retirees, helping them navigate the rising costs of living during their post-retirement years. This article delves into the intricacies of these salary hikes and pension increments, exploring their significance, mechanics, and how they impact employees and retirees alike.

Periodic Salary Hikes for Government Employees

The salary hikes for government employees are based on the recommendations made by a pay commission, which is constituted by the government every ten years. These hikes are implemented to ensure that the wages of government employees are aligned with the prevailing economic conditions. The government’s aim is to ensure that its workforce remains fairly compensated for their contributions while also ensuring that their salaries reflect the rising costs of goods and services.

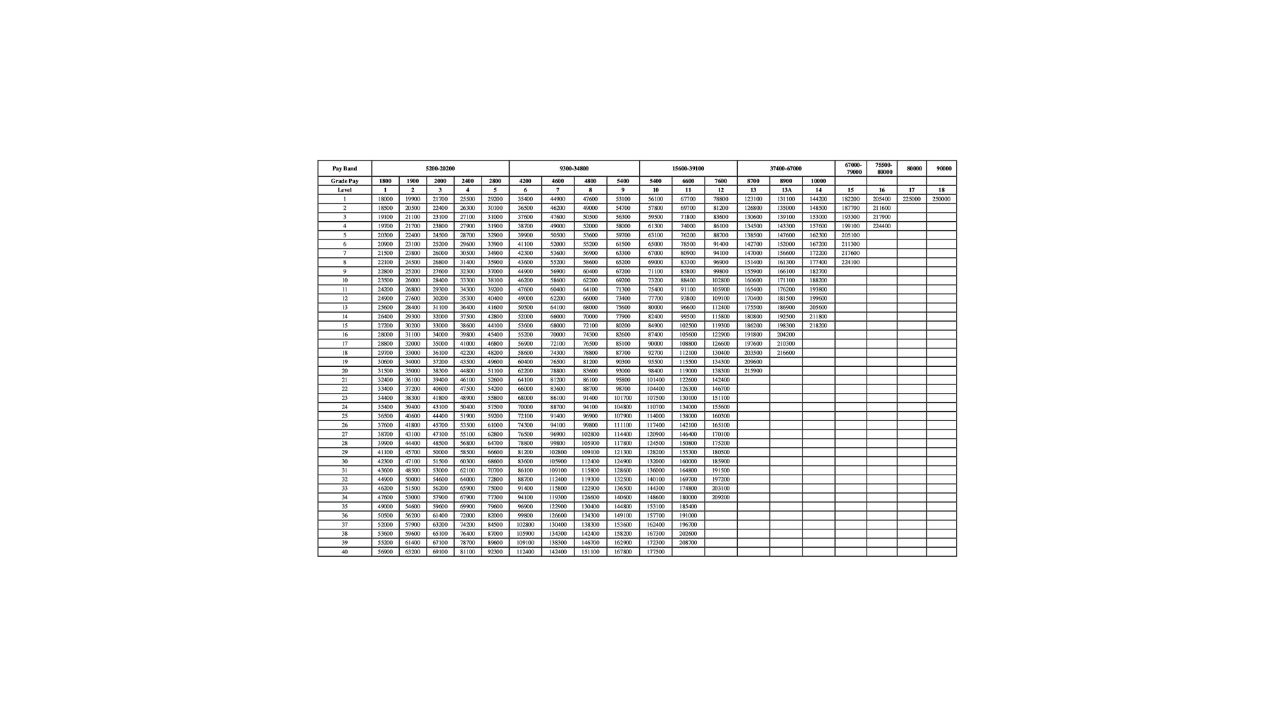

One of the key components of the salary revision process is the fitment factor, which plays a crucial role in determining the increase in the basic salary. The fitment factor essentially links the pay scale to the economic growth, ensuring that the government employees’ wages stay in line with the country’s overall economic trajectory. This system allows for a fair and consistent adjustment, preventing any major discrepancies between wages and the inflation rate.

In addition to the basic salary, the periodic increments also affect several allowances that government employees receive. Dearness allowance (DA), house rent allowance (HRA), and travel expenses are among the key allowances that are adjusted based on the new pay scale. These increments are designed to improve the “take-home” value of an employee’s salary, helping them cope with the rising cost of living.

These salary hikes are not arbitrary; they are carefully calibrated by the pay commission, which assesses factors like inflation, economic growth, and the overall cost of living. As a result, government employees benefit from a comprehensive pay structure that provides financial security, particularly in times of high inflation or economic instability. The periodic nature of these revisions ensures that government employees are not left behind in terms of income growth, even as the cost of living continues to rise.

Pension Increments for Retired Government Employees

While salary hikes are crucial for current employees, pension increments are equally important for retirees. Government pensioners also benefit from periodic hikes every ten years, which ensure that they can maintain a decent standard of living even after they have retired. Pensioners, like active employees, face challenges from inflation and rising living costs, which can erode the value of their pensions over time.

The pension increment system is designed to help retirees maintain their financial stability. Just as employees receive salary hikes, pensioners are entitled to a pension revision every decade. This revision allows pensioners to keep up with inflation and other economic shifts. The pension revisions are generally tied to the same pay commission recommendations that govern salary hikes for current employees. Therefore, when salary scales are revised, pensioners receive their corresponding increments, ensuring that their pensions remain relevant and adequate.

In addition to pension hikes, retired government employees are also entitled to several benefits, such as medical allowances and family pensions. These benefits help ensure that retirees do not face financial hardship when it comes to healthcare expenses or supporting their dependents. The inclusion of these allowances as part of the pension revision process further bolsters the financial security of retirees, allowing them to live with dignity in their post-retirement years.

The Impact of the Current Increment Decision

The most recent decision regarding salary and pension increments marks a significant shift in how the government approaches pay revisions. The announcement has brought dramatic changes in the way salary increases for employees are reflected in pensions. This new framework aims to provide a more seamless transition for both active government employees and retirees, ensuring that both groups benefit from the same level of economic growth and protection.

The administration’s focus on fair wage distribution is particularly evident in this current update. The adjustments are not only aimed at boosting salaries but also ensuring that retirees receive their fair share of the increment, thus promoting equity between active employees and pensioners. This policy shift reflects the government’s commitment to supporting both its current and former employees, recognizing their contributions and ensuring they have the financial security they need.

The focus on fair distribution ensures that the benefits of these pay revisions are felt across the spectrum, from entry-level employees to senior government officials, as well as pensioners. This system also takes into account the financial needs of employees at various stages of their careers and ensures that everyone benefits proportionally from the overall economic growth of the country.

The Importance of Long-Term Financial Security

The government’s periodic revisions of salary and pension scales offer long-term financial security to employees and retirees alike. These revisions are a vital part of the government’s welfare programs, ensuring that those who have dedicated their careers to public service do not face financial struggles in their later years. By adjusting salaries and pensions in line with inflation and economic growth, the government helps protect its workforce from the eroding effects of rising prices.

In an ever-evolving economic landscape, these adjustments provide a buffer against financial uncertainty. Employees and retirees can rely on these periodic hikes to maintain their purchasing power, allowing them to cover essential expenses such as healthcare, education, and housing. For retirees, these increments help prevent the loss of purchasing power, ensuring that they can continue to meet their needs without sacrificing their standard of living.

Additionally, the inclusion of various allowances as part of the salary and pension revision process further strengthens the financial security of government employees and retirees. These allowances, such as dearness allowance and medical allowances, help address specific needs that may arise due to inflation or changing circumstances. By integrating these allowances into the pay revision system, the government ensures that its employees and retirees are adequately supported.

Conclusion

In conclusion, the government’s approach to periodic salary and pension increments plays a pivotal role in ensuring the financial well-being of its employees and retirees. These revisions, which occur every ten years, are designed to keep up with inflation, economic changes, and the rising cost of living. The government’s commitment to fair wage distribution and the protection of retirees’ financial security is evident in the latest pay commission recommendations, which will benefit both current employees and pensioners.

As the country’s economy continues to grow and evolve, these periodic revisions offer much-needed financial stability for government employees at all stages of their careers, as well as for retirees who rely on their pensions for their livelihood. By carefully considering factors such as inflation and cost of living, the government ensures that its workforce remains protected from the challenges posed by economic fluctuations. Ultimately, these pay and pension revisions reflect the government’s ongoing commitment to the welfare and financial security of its employees and retirees, ensuring that they can continue to thrive in an ever-changing world.